Moody’s: The Survey’s Worthy Insights

The newest buyer survey from Moody’s Investors Service provides insight into the continued price increases in the reinsurance market. Expect these price increases to continue until at least 2024 across the board.

Reasons for the Continual Increase in Costs: Inflation Claims

According to the corporate study reported by Reinsurance News, rising costs are inevitable due to rising claim costs. In the property insurance industry, where reinsurance capacity faces challenges, this problem is more acute.

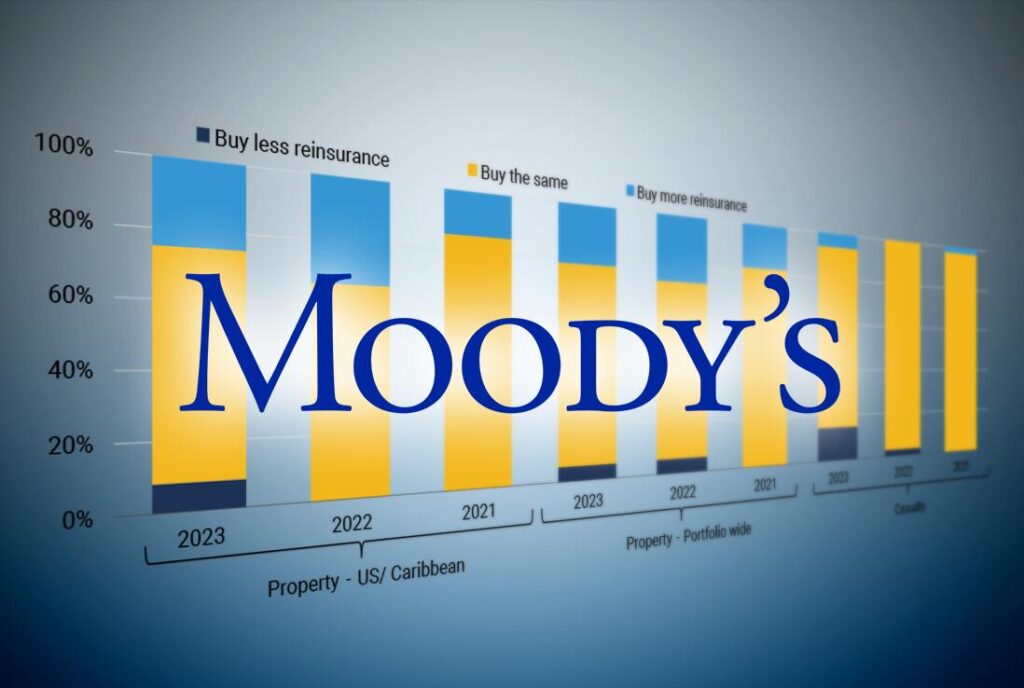

Surprisingly, the poll found that not many customers planned to purchase additional reinsurance in 2024 despite the rising cost of such protection. This indicates that huge insurance firms are prepared to bear a greater share of the costs related to future disasters.

Moody’s Future Predictions: What We Can Expect

According to the well respected rating agency Moody’s, prices would rise by the low to mid single digits over the year of 2024. The rate of growth predicted here is much lower than the rate seen in 2023. Seventy-plus percent of those surveyed expect more increases in premiums for all property and liability lines in the next year. About 44% of respondents share the consensus that accident reinsurance prices would increase by more than 5% in 2023.

Additionally, 40% of respondents anticipate property reinsurance price rises in the single digits. Moody’s highlights the fact that almost all cedants (insurance firms seeking reinsurance) attribute these price increases mostly to claim inflation. Interestingly, almost 60% of them also blame a decline in reinsurance capacity for these price hikes. Moody’s believes this is because of the unknowns caused by the persistent climatic issues and the inflationary atmosphere.

Nonetheless, Moody’s forecasts that price hikes will moderate generally. Compared to last year, when just 9% of respondents expected property reinsurance rates to remain unchanged, this year that number is expected to grow to 30%. Moody’s reports that some investors are concerned that property values might fall if the 2023 hurricane season is less severe than expected and supply continues to increase.

The Upward Trend Is Still In Effect

Moody’s states that over half of the main group (those responsible for purchasing reinsurance) is preparing for an overall rise in property reinsurance rates in 2024, notwithstanding the huge reinsurance price increases observed this year. If this happens, it would be the eighth year in a row that prices have gone up. Due to a very busy hurricane season, the reinsurance sector faced unprecedented losses that year.

Areas with the Greatest Cost Increases: Zones of Vulnerable Property

Moody’s suggests that disaster-prone property lines in the United States and the Caribbean will see the most price increases. Notably, 52% of respondents expect price increases in excess of 7.5%, which is only slightly lower than the 56% number from the previous year.

Moody’s draws attention to the fact that, despite property catastrophe costs being higher than they’ve been in a decade, almost a third of the main group still considers reinsurance pricing to be insufficient. This is a big jump over last year’s stated percentage of 13%. According to Moody’s research, the increasing danger from physical climatic changes has increased the unpredictability of adequate pricing. The rating agency has come to the conclusion that reinsurers have more difficulties in assessing acceptable price levels as a result of the rising frequency and severity of secondary risks such as convective storms, floods, and wildfires, and higher claims severity owing to economic inflation.